Sustainable Investments

March 31, 2021

At House Of Finance we consider the adverse impacts of investment decisions on sustainability factors in our Investment Advice and our Insurance Based Investment Advice, both at the initial stages of our research, in our recommendations and annually as part of the investment services we provide to our clients.

House of Finance your home for Sustainable Investments

Ask not what your planet can do for you…..

It’s been a bad start to 2021 for the financial services sector. Greed prevails- Davy, Ulster Bank and Dolphin Trust the headliners.

But what can we do about it?

Famine in Africa, deaths in Myanmar, flooding in India, melting of Polar ice caps, deforestation in the Amazon, child mining in the Congo. Don’t worry. our collective amnesia will get us through.

You are no different to the rest of us, or are you?

Good for you, Good for Society, Good for the planet.

The difference is you!

For most of us our pension is/will be one of the biggest assets we accumulate during our lifetime

Does your Pension Investment reflect your Ethics, Morals, Character and Ethos? It could

ESG funds seek to offer investment opportunities that have a positive Impact in the area’s of The Environment, Society(Social) and Corporate and Sovereign Governance.

Even if you can’t fully silence your inner Gordon Gekko, try being greedy in a sustainable way.

ESG funds are delivering and will attract further capital flows post covid. This is the future of Investment – It has to be!

Michael O Connell RPA SIA PTP is the managing Director of House Of Finance Advisory Services Ltd which is regulated by the Central Bank of Ireland. Unit prices fall as well as rise and past performance is not an accurate guide to future returns.

Nothing Happens without an Income!

October 25, 2018

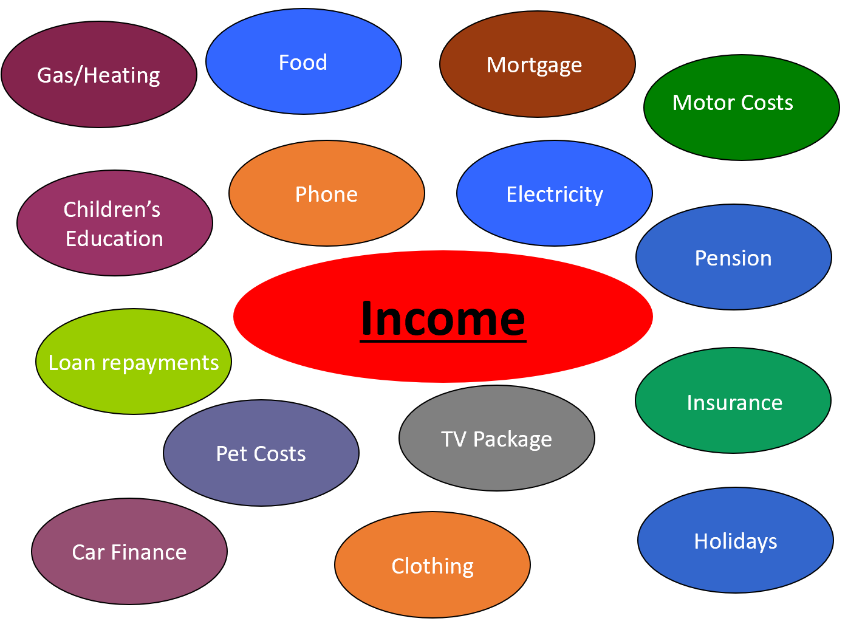

It’s amazing when we stop to think about it, how much we depend on our income.

Our lifestyle is inextricably linked to what we earn and the continuation of those earnings.

Why don’t we insure that income and lifestyle if we have the ability to do so.

Here’s how crazy it is:

- 8 out of 10 people insure their cars

- 7 out of 10 people insure their buildings

- 2 out of 10 insure our mobile phones and pets

- Only 1 out of 10 people insure their income, this is the income that pays for our Cars, Homes, Pets and our Phones.

So what is Income Protection?

An Income Protection policy is designed to payout 75% of your income in the event that you cannot continue to work due to any accident, illness or any condition that prevents you from working.

Who can take it out?

Pretty much anyone with an income, if you are a Company Director, the business can pay the cost of protecting your Income. If you are a sole trader or employee you can claim tax relief on the premiums. The cost of income is sensitive to your occupation and requires medical underwriting

How much income can you protect?

You can protect up to 75% of your income, less any Social Welfare benefits you are entitled to.

When will you start to receive a benefit?

Your monthly income protection payments will start after you are out of work due to illness or injury for 4,8, 13, 26 or 52 weeks, known as the Deferred Period and will continue until you are able to return to work. If you are not well enough to return to work, companies will continue to pay you until you retire .

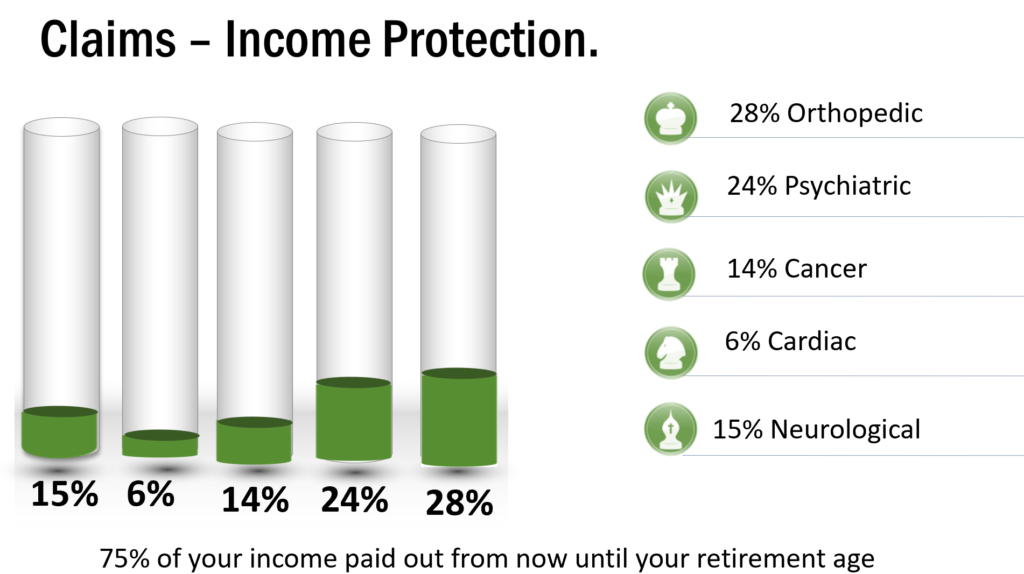

What are the biggest claims?

As an advisory firm we are passionate about income protection as the income underpins all financial plans. It may not be as expensive as you think, particularly when you can claim tax relief on the premiums

Help us spread the news about this unbelievable and underutilised protection product because nothing happens without an income.

Michael O Connell QFA FLIA APA SIA is the Managing Director of House Of Finance Advisory Services Ltd who are regulated by the Central Bank Of Ireland

Your Friend BOB!

Remember when a Job was for life, you entered employment with the Bank , Semi State or multinational after school or college and you stayed there, some might say institutionalised, until retirement at 60 or 65.

In the last 20 years however we have witnessed a Sea Change in the employment arena as employees change or cease employments for a number of reasons:

- Individuals actually want to enjoy and be challenged by what they do.

- Benefit Packages and advancement potential vary greatly between employers

- Large Scale redundancies during recession and globalisation

- Taking time out to travel or work abroad

- Rearing children with prohibitive child care costs

Whatever your reason for changing employment, the average person changes Jobs 10 to 15 times in their lifetime.

Each time you change employment you might have left something valuable behind, part of your retirement picture, a pension!

So If you left a pension(s) behind you are probably:

- Receiving very little if any information

- Unaware of what level of Risk you are taking

- Confused as to how you might access these funds in the future

This is where BOB might help, BOB is not your friendly financial adviser, that’s me, BOB is an acronym for Buy Out bond also know as a Personal Retirement Bond or PRB – the financial industry is full of acronyms. BOB may even allow you to access tax free cash from age 50, what a guy!

A Retirement Bond essentially transfers the ownership and decision making from the old scheme trustees to you, once the trustees sign off on the transfer you need never interact with the old employer / trustee again regarding your valuable retirement benefits.

Why would you consider moving your old pension benefits into a Personal Retirement Bond:

- Choice, you decide:

- Where it’s invested.

- How It’s invested.

- Charging Structures

- Risks

- Access:

- Access to information.

- Access to Trustees now

- Access to Retirement Options from age 50.

Buyer Beware! It is not always best advice to transfer your previous benefits to a Retirement Bond particularly where you have been a member of a Defined Benefit Pension Arrangement. Make sure you understand the implications of the transfer and that you are dealing with a Qualified, Experienced and Trustworthy Adviser such as House Of Finance Advisory Services Ltd.

Michael O Connell QFA FLIA APA SIA is the Managing Director of House Of Finance Advisory Services Ltd who are regulated by the Central Bank Of Ireland

Bob Dylan, Folk Legend and Pension Prophet?

June 9, 2014

Pensions – “The Times They are a changing!”

There is a song by Bob Dylan in which he tells us to gather around, that the waters are getting higher and we better start swimming or we’ll sink like a stone. This reminds me of the current position we find ourselves in relation to our pensions.

If you are under the age of 52, you may or may not be aware that the government changed the age in which you will be entitled to receive your OId Age Pension from 65 to 68.

If the government pension was to remain as is i.e. in the region of €12,000 per annum, this would mean that you would lose out on three years of €12,000 i.e. €36,000. If you are a married person your spouse may also miss out in those three years and that €36,000 so effectively the Government has take €72,000 off our retirement income.

Unlike other more hot blooded European countries we didn’t march on the street, we didn’t riot, we just got on with it as usual.

Why has the Government made this decision? Well part of the reasons is because of the demographic time bomb that exists in relation to the state pension. At the moment for every one person in receipt of the state pension there might be 6 people working and paying Income Tax to fund the state pension for those over the age of 65.

In 20 years time there may only be 3 people working for every one person in receipt of the state pension. The reasons for this:

• We’re having less children

• We’re living longer

• Emigration and unemployment.

Not only has our normal retirement age been pushed back from 65 to 68, we cannot guarantee what level of pensions we might receive into the future.

So by choosing not to riot, we chose not to get mad but can we get even? Well the answer is yes because pensions still attract tax relief on their contributions and if you’re a higher rate tax payer for every €100 you invest into a pension the Government will invest a further €41 on your behalf in the form of tax relief. There is no doubt that private pensions and employer sponsored schemes are a way of bridging the gap between what the Government may pay you at age 68 and what your requirement for income may be when you retire.

So again to paraphrase the great Bob Dylan once more ‘the line it is drawn, the curse it is cast… as the present now will later be past, the order is rapidly fading’.

Talk to your employer today in relation to providing you with pension benefits in your place of work. Look at previous employment and any old pension benefits that you may have arising from them. Talk to a Financial Advisor about making tax efficient contributions to a retirement fund. Take the future into your own hands now, you cannot rely on future Governments for the times they are a changing.[/vc_column_text][/vc_column][/vc_row]

Our Top Ten Financial Tips

With our top 10 financial tips we hope to give you a helping hand when it comes to managing your finances.

1. Plan a household budget:

A family budget can help you control your household spending so that you have enough money to pay your bills and cover the basics on an ongoing basis.

2. Start an emergency fund:

Always have some money put by for unexpected events – we never know what’s around the corner. A rule of thumb is to have at least 3 months’ salary saved for emergencies.

3. Get better value:

The Economiser is an interactive tool from the National Consumer Agency that helps you compare your spending against what other people are spending in areas such as mobile phones, broadband, groceries and energy.

4. Manage your credit card. Here are some handy tips:

Set up a direct debit

Take the hassle out of making manual payments to your account every month by letting the Direct Debit do the hard work for you. You can choose what percentage you want to pay and this means you avoid any unnecessary late payment fees and reduce interest charges by always paying on time.

Plan your spend

Make a list and decide what you will use your credit card for e.g. emergencies, lifestyle purchases such as concert tickets, plane fares etc and what you will use your debit card for e.g. every day items such as grocery spending etc. Set yourself guide lines and stick to them. This way you avoid any unnecessary impulse spending.

Check your statement

There’s a number of ways to check your account including over the phone and on-line. Reviewing your account regularly will keep you in control of your spending and you won’t accidentally go over your credit limit and incur fees.

5. Get protected: Life insurance is not a luxury – it’s a need:

If you want to cut costs, buying an insurance plan might not appear to make much sense. But a life cover plan is not a luxury, it’s a fundamental need. It helps maintain a family’s regular standard of living if something happened to the main breadwinner. Research conducted in December 2010 by iReach Market Research found that nearly six in ten Irish parents felt they would struggle financially in the event of death or illness in the family. That’s why protection is something which really needs attention.

For example, in reality the cost of €100,000 life cover is actually below €20 per month! So, for less than the cost of three bottles of wine a month you could help get your family protected.

6. Get your tax back:

Although some tax reliefs and credits have been abolished in the recent Budget, you can still claim tax back on many items, for example

Medical fees

Renting your home (Rent Tax Credits)

Pension and Income Protection plans

Mortgage interest

Renting a room in your home to a private tenant (Rent a Room relief)

Service charges for refuse collection, sewage disposal or domestic water supplies

Fees paid for approved third-level courses

Why not go to www.revenue.ie for a full list of tax reliefs available.

7. Plan for your retirement:

By starting a pension sooner rather than later, you can plan ahead to enjoy the retirement you want. In the next few years, the state pension won’t start until age 68, that’s why having your own pension plan is vital. Despite the tax relief changes to pension plans announced in the Budget, those investing in pensions can still get full tax relief this year – so you should really make the most of this while you still can. In the Governments 4 year plan the tax relief will gradually fall to 20%. This is still very generous!

8. Become a super-saver:

With credit still difficult to come by, now may be the time to devise a ‘super-savings’ plan to help you get in the habit of squirreling away as much as you can. So instead of opening just one savings account, you could open a number of regular savers, each designed to help pay for things like holidays, new car, third level education costs and home improvements.

9. Be smart with your investments:

Consider an investment that suits your needs by doing a risk profile test to identify what type of investment is right for you. Generally, best advice is to spread your money across different types of investments/assets.

10. Give your finances a regular check-up:

Finally, It’s really important to regularly review your finances with your Financial Advisor, this way you’ll find it easier to keep on top of things. You can set up an appointment to review your finances free of charge.

Aviva’s Best Doctors

November 9, 2013

Best Doctors offers a world-class second medical opinion service by drawing on the knowledge of medical experts. It helps to ensure that you have the right diagnosis, leading to the right treatment and the right care

If you have access to Best Doctors and are diagnosed with a significant medical condition, you can call Best Doctors and a leading medical specialist will review your diagnosis and treatment. You will be guided through the medical process, helping you to understand your options and giving you and your treating doctor the necessary information, ensuring that you receive the best possible treatment.

- 17% had a change in diagnosis

- 32% had a change in treatment

Best Doctors will only share your report with your treating doctor if you authorise Best Doctors to do so. The goal of Best Doctors is to provide useful information so that you and your doctor are able to make more informed decisions together regarding treatment. Treating doctors who have worked with Best Doctors appreciate having access to respected experts in their field of practice. They also gain access to information regarding innovative diagnostic and treatment protocols that might not be available to them otherwise.

How does Best Doctors build its network of specialists?

Doctors are selected through a comprehensive review process. In participating countries, doctors are selected through a peer-driven survey conducted by Best Doctors. Doctors are asked questions in this survey to find out which doctors they trust most. Every doctor surveyed answers the question: “If you or a loved one needed a doctor in a certain speciality, who would you choose?” Best Doctors has grown its global database to more than 53,000 specialists and subspecialists, over the past 20+ years. Doctors cannot buy themselves into the database, nor do they pay fees to be included. The only way the doctors can be accepted into the database is through a peer-reviewed poll.

See video of how it works here.

When Should You Call Best Doctors

Best Doctors assists members with a wide range of medical challenges, from back pain to surgery to life-threatening illnesses. You should call Best Doctors if:

- You are looking for a second opinion related to anything from a straightforward surgical procedure to a chronic condition or a serious illness

- You are questioning a diagnosis and/or treatment plan

- You have questions about a medical condition, treatment, test results or personal health issue

- You need help understanding a diagnosis, treatment plan or medical condition

- You need help managing your symptoms

Important notes

- One policy can cover you, your spouse or partner and your children up to 18 or 23 if they are in full time education.

- Best Doctor’s don’t apply any exclusions for pre-existing conditions

If you are uncertain about whether Best Doctors can help, do not hesitate to call. It’s your health – be absolutely sure.