Whether you have an existing portfolio that you want to be reviewed or you are stepping into the investment markets for the first time, we can help.

We take time to get to know your investment objective and your tolerance for risk.

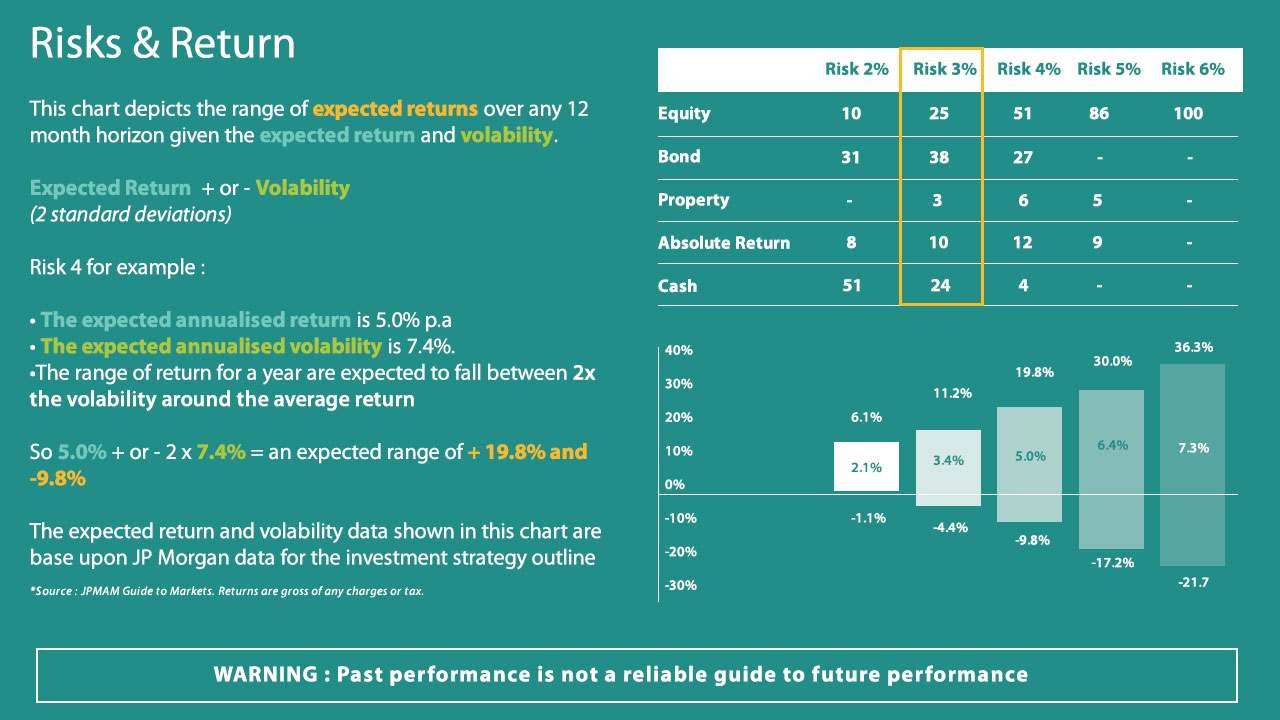

To make investment decisions, you need information that will help you form an idea of the economy, industry, risk and return that may affect your choices. We aim to sort through the information to find the most relevant to your investment interests and proceed from there. We will then outline a bespoke plan designed to achieve your objectives, and we will review the plan with you regularly.

We help you understand the essential questions of investing.

Ask yourself how long you can invest for? What are your investment goals? Are they realistic?

We aim to ensure and follow the golden rules of investing:- The importance of minimising the odds of you suffering irreversible losses.

- The importance of maximising the chances of you achieving sustainable gains.

- The importance of trying to control the self-defeating behaviour that keeps investors from achieving their long-term goals.

At House of Finance assess your personal needs for retirement provision by applying our experience and expertise to your present circumstances and future goals.

We provide choice and a clear understanding of your financial solutions

![]()

Invest

Tax relief

Risk tolerance

Choice

![]()

Grow

Tax-free growth

Volatility

Review

![]()

Protect

Tax-free cash

Access mechanisms

Reduced risk

Protection from creditors

We provide advice in the following areas :