Sustainable Investments

March 31, 2021

At House Of Finance we consider the adverse impacts of investment decisions on sustainability factors in our Investment Advice and our Insurance Based Investment Advice, both at the initial stages of our research, in our recommendations and annually as part of the investment services we provide to our clients.

House of Finance your home for Sustainable Investments

Ask not what your planet can do for you…..

It’s been a bad start to 2021 for the financial services sector. Greed prevails- Davy, Ulster Bank and Dolphin Trust the headliners.

But what can we do about it?

Famine in Africa, deaths in Myanmar, flooding in India, melting of Polar ice caps, deforestation in the Amazon, child mining in the Congo. Don’t worry. our collective amnesia will get us through.

You are no different to the rest of us, or are you?

Good for you, Good for Society, Good for the planet.

The difference is you!

For most of us our pension is/will be one of the biggest assets we accumulate during our lifetime

Does your Pension Investment reflect your Ethics, Morals, Character and Ethos? It could

ESG funds seek to offer investment opportunities that have a positive Impact in the area’s of The Environment, Society(Social) and Corporate and Sovereign Governance.

Even if you can’t fully silence your inner Gordon Gekko, try being greedy in a sustainable way.

ESG funds are delivering and will attract further capital flows post covid. This is the future of Investment – It has to be!

Michael O Connell RPA SIA PTP is the managing Director of House Of Finance Advisory Services Ltd which is regulated by the Central Bank of Ireland. Unit prices fall as well as rise and past performance is not an accurate guide to future returns.

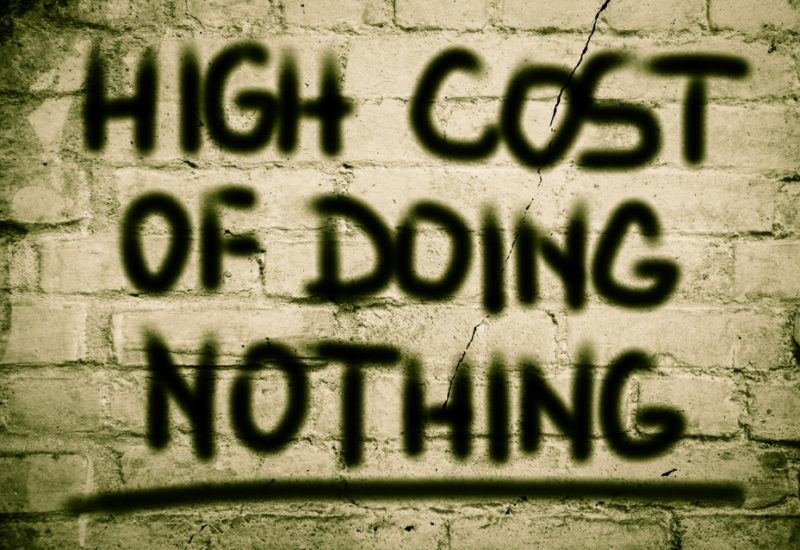

Nothing Happens without an Income!

October 25, 2018

It’s amazing when we stop to think about it, how much we depend on our income.

Our lifestyle is inextricably linked to what we earn and the continuation of those earnings.

Why don’t we insure that income and lifestyle if we have the ability to do so.

Here’s how crazy it is:

- 8 out of 10 people insure their cars

- 7 out of 10 people insure their buildings

- 2 out of 10 insure our mobile phones and pets

- Only 1 out of 10 people insure their income, this is the income that pays for our Cars, Homes, Pets and our Phones.

So what is Income Protection?

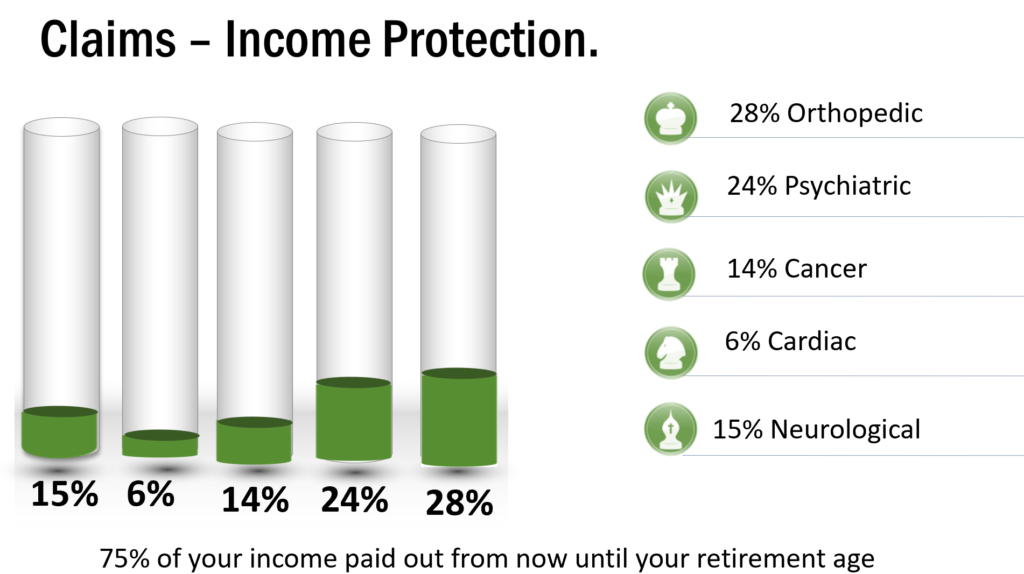

An Income Protection policy is designed to payout 75% of your income in the event that you cannot continue to work due to any accident, illness or any condition that prevents you from working.

Who can take it out?

Pretty much anyone with an income, if you are a Company Director, the business can pay the cost of protecting your Income. If you are a sole trader or employee you can claim tax relief on the premiums. The cost of income is sensitive to your occupation and requires medical underwriting

How much income can you protect?

You can protect up to 75% of your income, less any Social Welfare benefits you are entitled to.

When will you start to receive a benefit?

Your monthly income protection payments will start after you are out of work due to illness or injury for 4,8, 13, 26 or 52 weeks, known as the Deferred Period and will continue until you are able to return to work. If you are not well enough to return to work, companies will continue to pay you until you retire .

What are the biggest claims?

As an advisory firm we are passionate about income protection as the income underpins all financial plans. It may not be as expensive as you think, particularly when you can claim tax relief on the premiums

Help us spread the news about this unbelievable and underutilised protection product because nothing happens without an income.

Michael O Connell QFA FLIA APA SIA is the Managing Director of House Of Finance Advisory Services Ltd who are regulated by the Central Bank Of Ireland